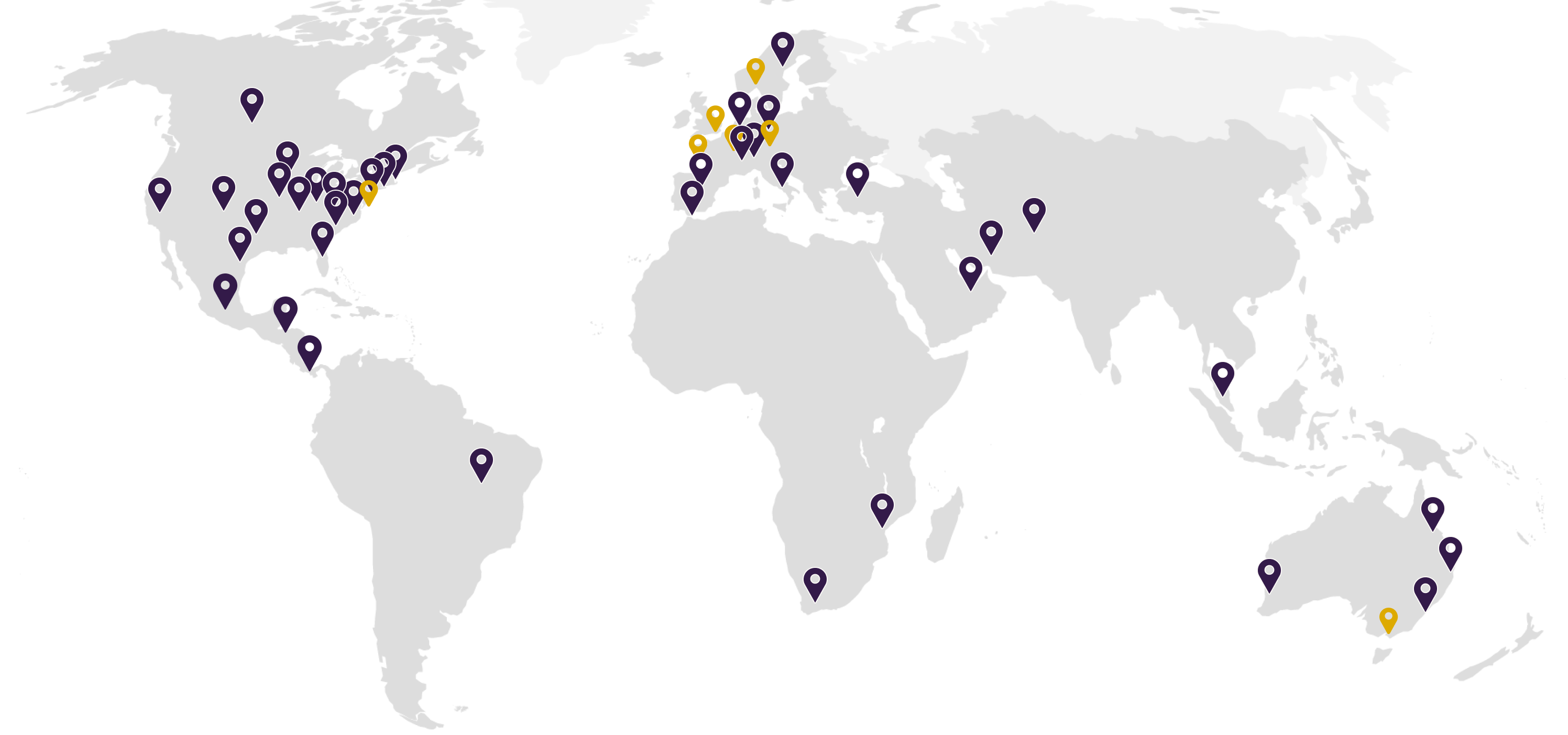

Investing in the Rule of Law

Therium provides third-party funding for a comprehensive range of cases, including single cases, group litigation and arbitration to corporates, investors and individuals.

- Single Cases

- Arbitration Cases

- Group Litigation Cases

- Law Firm Portfolio Funding

- Corporate Portfolio Funding